florida estate tax rate

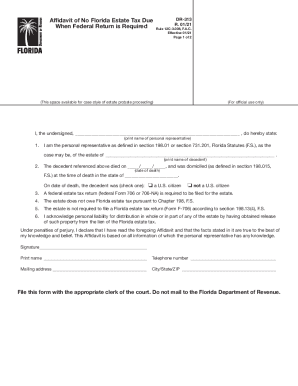

Previously federal law allowed a credit for state death taxes on the federal estate tax return. Online information - E-mail address.

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

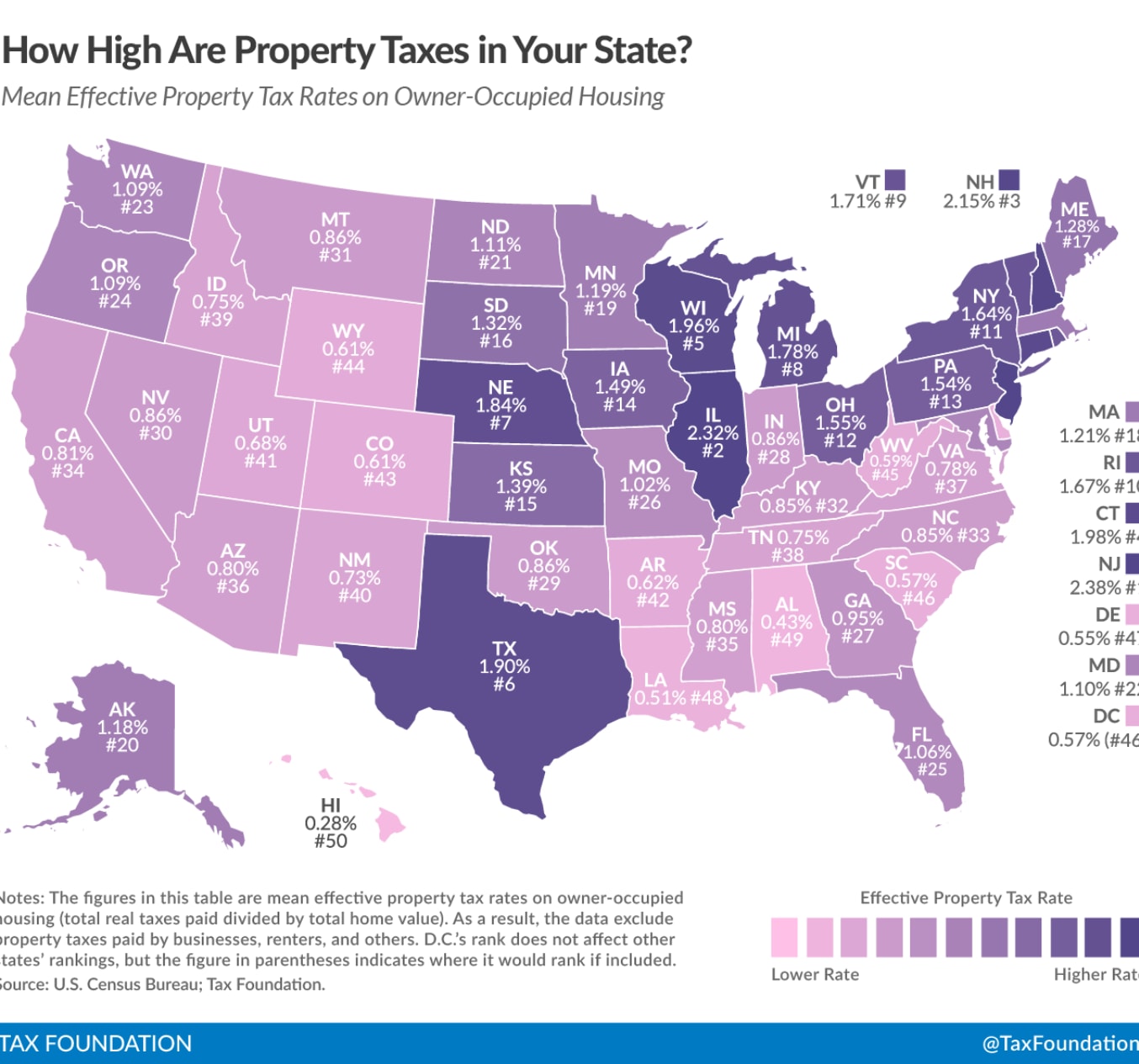

Property taxes in Florida are right in the middle of the pack nationwide with an average effective rate of 083.

. 2 the duty of. We facilitate current and delinquent real and personal property taxes special assessments for all local taxing authorities local business tax receipts and convention and tourist taxes. If you do not qualify under the Governors Executive Order the Tax Collector has.

For many property taxes are going up alongside property values. We have an increase of about 160000 in value for the year Perry said. Please make your check payable to.

If real estate taxes remain unpaid Florida statutes require the tax collector to conduct an annual tax certificate sale on or before June 1 for all land on which real estate taxes are delinquent for. 2 days agoWith Floridas overall appraised home values skyrocketing by 26 between 2021 and 2022 according to an analysis of state data those buyers could owe thousands more in. Ranked 29th for most Property Taxes Paid per person.

Counties in Florida collect an average of 097 of a propertys assesed fair. Thomas Pinellas County Tax Collector. Amusement machine receiptstaxed at 4.

Section 197122 Florida Statutes charges all property owners with the following three responsibilities. 1 the knowledge that taxes are due and payable annually. The state charges a 6 tax rate on the sale or rental of goods with some exceptions such as groceries and medicine.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Property taxes must be paid in full at one time unless on the. Florida estate taxes were eliminated in 2004.

There are also special tax districts such as schools and water management districts that. The average property tax rate in Florida is 083. Lease or commercial real property licensetaxed at 55.

Floridas property tax rate of 094 is 017 less than the national average. Real estate property taxes. 2480 Thompson Street Fort.

The Florida sales tax rate is 6 for everything except. Additionally counties are able to levy local taxes on top of the state. There are two types of ad valorem or property taxes collected by the Lee County Tax Collectors office.

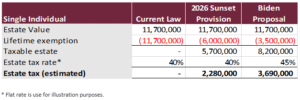

The federal government then changed the credit to a deduction for state estate. Each county sets its own tax rate. Instead individuals and families pay a federal estate tax on transferring property upon death when an estate exceeds a specific threshold.

There is no estate tax in the state of Florida. Coming from Alabama the state with. The Tax Collector may have a program to assist you with deferring taxes and paying in quarterly installments.

Florida Inheritance Tax And Estate Tax Explained Alper Law

U S Estate Tax For Canadians Manulife Investment Management

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax Planning And Using A B Trusts For High Net Worth Estates Estate Planning Attorney Gibbs Law Fort Myers Fl

How Do State And Local Sales Taxes Work Tax Policy Center

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Council Votes 12 4 To Keep Duval County Property Tax Millage Rate Unchanged Jax Daily Record Jacksonville Daily Record Jacksonville Florida

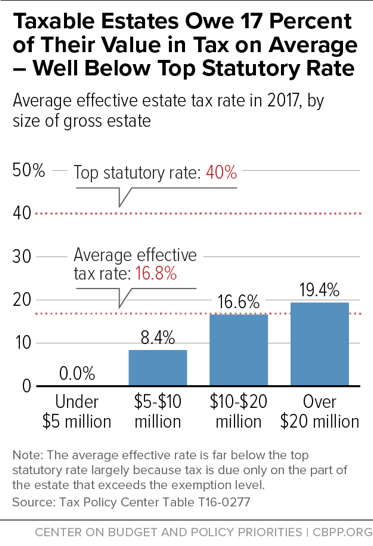

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

U S Estate Tax For Canadians Manulife Investment Management

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Florida Inheritance Tax And Estate Tax Explained Alper Law

Florida Property Tax H R Block

Florida Estate Tax Everything You Need To Know Smartasset

Florida Dr 313 Fill Out And Sign Printable Pdf Template Signnow

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning